What’s Ahead for CMBS & Commercial Real Estate in 2013?

January 12, 2013

By Malay Bansal

Why did CMBS perform well in 2012 and what lies ahead.

Note: These views were originally quoted on 19 Dec 2012 in article “Rally Drivers” in Structured Credit Investor. This article was also published on Seeking Alpha.

In 2012, the CMBS market had a significant rally as is evident from the table below showing bond spreads over swaps.

|

2011 Year End |

2012 Year End |

|

| GG10 A4 |

270 |

150 |

| CMBS2 Senior AAA (A4) |

120 |

90 |

| CMBS2 Junior AAA |

265 |

140 |

| CMBS2 AA |

400 |

180 |

| CMBS2 BBB- |

700 |

470 |

Not only were the spreads tighter significantly over the year, the performance was better than expectations by almost any measure. Issuance for the year was $48 Bn compared to forecast of $38 Bn. The new issue 10 year AAA spread to swaps ended at 90 compared to forecast of 140, and new issue BBB spreads ended at 410 compared to a forecast of 587 (all forecasts are averages of predictions by market participants as published in Commercial Mortgage Alert). The spread tightening was not limited to new issue either, legacy CMBS prices were up significantly too. Why did CMBS do better than expected, and can this trend of higher issuance and tighter spreads continue?

Why did Spreads Tighten?

There are two widely talked about reasons for spread tightening that generally apply to most of the spread products, and a third one that is specific to and very important for CMBS and commercial real estate.

First driver of spread tightening is the purchase of large amount of mortgage securities by the Federal Reserve under its quantitative easing programs and investors search for yield in this low yield environment.

Second significant factor is that the universe of spread product is shrinking as mortgage payoffs are greater than new issuance. $25-30 Bn of net negative supply per year in CMBS means that the money that was invested in CMBS is returned to investors and needs to be reinvested. More demand than supply leads to higher prices and tighter spreads.

The third factor is a chain reaction that is more interesting and significant. As the above two reasons lead to tighter spreads for new issue CMBS bonds, the borrowing cost for commercial real estate owners decreases. Lower debt service payments from lower rates mean they can get higher loan amounts on their properties. That means a lot of existing loans that were not re-financeable or were border-line and expected to default can now be refinanced and do not need to default. As more loans are expected to payoff and expected defaults decrease, investors expect smaller losses in legacy CMBS deals. That means tranches that were expected to be written off may be money good or have lower losses. So investors are willing to pay more for them, and as people move down the stack to these bonds with improved prospects, the result is tighter spreads for these legacy bonds. Lower financing cost resulting from tighter bond spreads also helps increase liquidity and activity in commercial real estate market as it allows more investors to put money to work at returns that meet their requirements. More activity in the real estate market leads to more confidence among investors and increases real estate values, further reducing expected losses in loans leading to even tighter bond spreads. This chain creates a sort of virtuous circle – the exact opposite of the downward spiral we saw in previous years when the commercial real estate market deteriorated rapidly.

Looking Ahead

As the virtuous cycle mentioned above continues, barring any shocks, spreads can continue tightening and lower financing cost from CMBS means that it can compete more with other sources of financing which means that CMBS volume can keep increasing. Indeed, the forecasts for CMBS issuance for 2013 generally range from $55 Bn to $75 Bn, up from $48 Bn in 2012.

Spreads, however, have less scope for tightening than last year in my view. Looking at historical spreads in a somewhat similar environment (see What’s Ahead for CMBS Spreads? April 4, 2011), CMBS2 AAA spreads could be tighter by 20 bps and BBB- by another 140 bps this year. Generally rising confidence in underlying assets should result in a flatter credit curve, which implies more potential for gains in the middle part of new issue stack. Spreads will move around. Given the unprecedented low yield environment, the search for yield by investors could drive spread slower than expected. At the same time, events in or outside US could cause unexpected widening. The market obviously remains subject to any macro shocks.

One concern cited by many investors is the potential loosening of credit standards by loan originators as competition heats up. That is a valid concern and if industry participants are not careful, history could repeat itself. However, though credit standards are becoming a little looser (LTVs were up to 75 in 2012 from 65-70 in 2011 and Debt Yields were down to 9-9.5% from 11% a year ago), we are nowhere close to where industry was in 2007. Still, investors should watch out for any occurrences of pro-forma underwriting if it starts to re-emerge.

Looking further ahead, maturities will spike up again in 2015-2017, with around US$100bn of 10-year loans coming due. This could cause distress, but hopefully the commercial real estate market will have recovered enough by then to absorb the maturities. Still, it is something that we need to be mindful of for next few years.

For me, one of the most important factors to watch out for is the continued supply of cheap financing for real estate owners. That has been one of the main factors that has brought us to this point from the depths of despair at the bottom and was the basis for programs like TALF & PPIP (see Solving the Bad Asset Pricing Problem) four years ago.

In the current low-growth and low-cap rate environment, investors cannot count on increase in NOI or further decrease in cap rates to drive real estate values significantly higher. That makes availability of cheap financing critical and much more important than historically for achieving their required rates of return to make investments.

Any disruption in availability of cheap financing can quickly reduce the capital flowing to real estate sector and may reverse the positive cycle that is driving spreads tighter and increasing real estate values. Anything that could reduce the availability of financing for commercial real estate owners will be the most important thing I will be looking out for this year other than the obvious factors.

In commercial real estate, hotels and multi-family have improved the most. Hospitality sector, with no long leases, was the first to suffer and among the first to gain as economy started improving. Multifamily sector has done well benefiting from the financing by GSEs. Office and retail sectors have seen increasing activity but face a high unemployment and low-growth environment. If the economy keeps improving at the current slow rate, I think the industrial sector will offer more opportunities and see more activity this year.

Note: The views expressed are solely my own and not of any current or past employers or affiliated organizations.

Observations on CMBS Spread Forecasts

August 22, 2009

By Malay Bansal

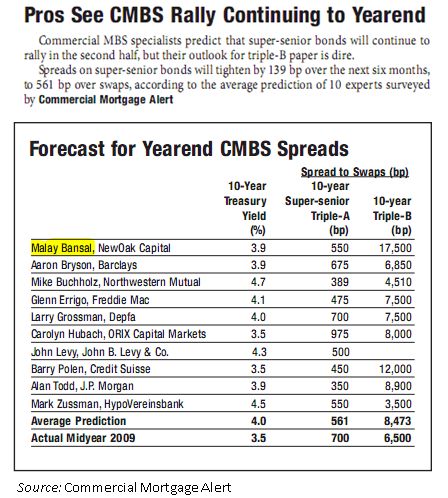

It’s always interesting to analyze forecasts about future spreads and yields. CMBS industry’s weekly newsletter, Commercial Mortgage Alert publishes predictions on future CMBS spreads every January & July. I have always liked to look at them to see what market participants are thinking, and if any interesting insights can be gleaned from their predictions.

The table below is the latest set of forecasts published. It shows predictions from ten industry participants on where recent vintage (i.e. 2006 to 2008 deals) CMBS spreads will be six months later. Some observations follow.

Let’s start with the averages. The average prediction suggests that, six months later, Super Senior AAAs will be tighter but BBB spreads will be wider. Credit curve will be steeper. That makes sense and reflects the belief of many that CMBS will face losses but not to an extent that it will impact super-senior AAA tranches in most deals. Range of 350 to 975 is wide, but not that much given the current uncertainty.

The BBB forecasts are more interesting – with a really wide range from 3500 to 17500. The majority expects spreads to widen, but the widest spread is mine. Why am I negative on recent vintage BBB and BBB- bonds? My reasons are not different from others, and so are not that interesting (and hence listed as a footnote at the end). What is interesting to me is a question I have been asked multiple times – if I am twice as negative as the average and why? With average prediction of 8473, and my prediction of 17500, it is a fair question. So, let’s examine that in a little more detail.

The current spread for BBB is listed as 6500 bps over swaps. If we take a single bond as a representative of the sector, that spread implies a yield of about 68.5%, a price of about 10.40, and Modified Duration of 1.6. The bond has a coupon of 6%. If you buy the bond at a price of 10.40, at the end of second year, you would have received 12.00 in coupon payments (2 years at 6%/year), which is all of original price you paid for the bond plus about 15%. In effect, the market is saying that it expects these bonds to receive just about two years of coupon, and not much else after that. In other words, the market price implies that it expects these bonds to be wiped out after about two years.

If you logically follow that belief, then after 6 months, an owner of the bond would have received 3.00 and should be expecting one and a half year more of cashflows. So the price of the bond would be roughly 3.00 lower than 10.40, or 7.40. Indeed, that price is not too far from what the average spread prediction would result in. In other words, the average spread prediction of 8475 implies that the market will be expecting about 1.5 years of cash flows. In comparison, my prediction of 17500 assumed expectation of only 1.0 year of cashflows. So, I am not twice as negative as the average, just a little more – difference being 6 months in cashflows for seven year bonds. So, why such a big difference in spreads? That has to do with the current low prices of these bonds, and the fact that as bond prices decrease, duration decreases too. For a bond priced at 10.00 with a duration of 1.0, a 100 basis point change in yield results in a change in price of 1%, or just 0.10 (1% of 10.00). As duration decreases, it takes a larger change in spreads to make a difference in price. That bond math explains the big difference in spreads, but that is not the important point. The important observation here is that, whether expectation is for 12 or 18 (or something in between) months of remaining cash flows, it reflects a pretty negative expectation for bonds that will have about 7 years remaining to maturity.

Despite the negative expectations, there is another point that is important to keep in mind – it is a simple one but is often missed by many, especially in media reports – CMBS and property markets are linked, but are separate markets, and one can be way ahead of the other. It is entirely possible for commercial real estate to face problems at property level, but CMBS BBBs to tighten. That is another way of saying that, despite all the issues mentioned, it is entirely possible that the majority may turn out to be wrong. Note that there were two predictions for tighter spreads on BBB. There are scenarios possible under which losses in CMBS will be limited even with problems at property level, and that will logically lead to a significant rally in the BBB tranches. A lot will depend on government and industry steps, some of which are helping tighten spreads, but I do not yet see steps that make the more optimistic scenarios likely. Apparently, neither does the majority.

Here is perhaps the most important point of this article: if you are not sure and have doubts about extent of losses in BBB and BBB- classes, then AA and single-A classes at prices in 20s with subordinations of 9.8% and 7.5% (and same about 6% coupon), have to be a bargain, especially if you can do the credit work and pick the right deals.

Note: The views in this article and my spread predictions in the Commercial Mortgage Alert article referenced are solely my own.

Nov 2010 Update:

Tranche Price in June 2009 Price in Nov 2010

BACM 2006-6 B 26.00 54.00

MLMT 2005-CKI1 C 40.00 80.50

GCCFC 2005-GG5 B 40.00 73.30

___________________________________

Footnote:

Some Reasons for being negative on recent vintage BBB & BBB- CMBS

Consider the following facts and opinions:

- Commercial property values are down 34.8% from Oct 2007 peak, as measured by the Moody’s/REAL CPPI index.

- Average subordinations for 2007 BBB and BBB- were 4.20% and 3.10% respectively. That means losses of approximately 4.20% and 5.3% will result in complete write-down of these tranches.

- Appraisal reductions can lead to interest shortfalls (via ASERs) and can stop cash flows to the subordinate bonds long before actual write-downs.

- It remains very difficult to refinance maturing loans, especially those with larger sizes. 29% of all loans that matured this year remain outstanding. Of the 5 year loans that matured this year, only 50% were refinanced. Number of CMBS loans maturing increases dramatically from $18 Bn this year to 35 Bn next year, and 56 Bn two years later.

- Loans going in special servicing generally require new appraisal and can result in appraisal reductions before actual losses. According to Fitch, loans in special servicing are expected to increase from current $50 Bn to 100 Bn (or about 14% of total outstanding universe on average) by year end. In addition to losses, the special servicing fee of 0.25% on loans in special servicing will reduce cash flow to bonds increasing interest shortfalls.

- Among just the large loans, about 15 Bn with pro-forma underwriting with expectation of higher cash flows have not realized the expected increased cash flows. They are paying debt service at present, but may default in next 6 to 12 months once the interest reserves are completely used up.

- Over next few years, partial IO loans will start to amortize after the initial 2 to 5 year interest-only period. Increased debt service may not be fully covered by property cash flow, leading to defaults. In 2007 vintage, about 32% loans were partial IO along with 53% that were interest only to maturity.

- Delinquencies are still very low, even for loans with cash flow not covering debt service. In 2007 vintage, roughly 14.7% loans have debt service coverage level of less than 1.0.

- Overall delinquencies are expected to increase. For example, JP research expects aggregate delinquency to reach 4% by year end, and 10% by end of 2010. DB research expects delinquencies to reach 6-7% by end of 2009 in aggregate, and high-teens to 20% for 2007 vintage. REIS expects delinquencies to possibly reach 7% by year-end. Last time delinquencies were higher than 6% was in 1991 after the S&L crisis.

- Significant losses are expected in the recent vintage deals, even before maturity of loans. For example, DB research expects term losses, i.e. losses before maturity, to be 4.3 to 6.3% for the entire CMBS universe (with total cumulative losses of 10% including those at maturity), and 8.4% to 12.1% for the 2007 vintage. Fitch expects cumulative losses on 2006 to 2008 vintage deals of approximately 8% (maybe more than 14% for some 2007 deals), with 25% of loans possibly defaulting before maturity.

Make Your Own Opinion About Commercial Real Estate

August 2, 2009

By Malay Bansal

Note: This write-up was published on Seeking Alpha website and was selected as an Editor’s Pick article.

Much has been written about the issues faced by Commercial Real Estate, extent of losses the CMBS bonds will sustain, whether the TALF, PPIP and other government programs will help, and if the commercial real estate market is showing signs of bottoming or is going to keep declining a lot more. There are various views which all seem plausible. If you are not professionally involved in real estate, or if you do not already have a definite view, how do you go about developing your own opinion? This article is an attempt to help with that process.

First step in the process is defining the problem being faced by the CRE market. It is a complex problem and yet the best description of it I have seen is a simple one sentence comment reportedly made by a panelist at a recent industry conference organized by CMSA:

“We have gone from a 6% Cap, 80% LTV world to a 8% Cap, 60% LTV world.”

That is another way of saying the CRE market faces a double-whammy of falling prices and reduced availability of debt, but the use of numbers in this short one sentence elegantly and succinctly captures the essence of the problem. A simple example will help explain.

Let’s take a commercial property, say an office. It is year 2006, property generates $600,000 in rental income per year, and cap rates are 6%. That results in value of $10 mm (600K/6%). In an 80 LTV world, Larry the Landlord buys the building for 10 mm, borrowing 8 mm (80% of 10 mm) for 5 years from a CMBS lender, and using 2 mm of his own money. Now fast forward to a time closer to loan maturity. In the new world, cap rates are 8%, so the new value is lower at 7.5 mm (600K/8%), and the new loan amount is 4.5 mm (60% of 7.5 mm). To refinance, Larry needs to pay off 8 mm, but can only get 4.5 mm in new loan. So, he needs to come up with 3.5 mm. If he has that money or can raise it from somewhere else, he can refinance the old loan and continue to own the property.

If Larry can not raise the additional amount, or if he does not think that it is economically worthwhile to do so, then the loan is foreclosed, and one option for the lender is to sell the property. Ideally, the property can be sold for 7.5 mm, the new value. In the worst case, there should be plenty of buyers at 4.5 mm (since one can buy the property no money down using the 4.5 mm debt available in the new world). The actual price will be somewhere between the two depending on how many buyers are there with cash available to buy, and what is their view of real estate prices in future.

By using the above numbers, we can quantify the range of expected losses in cases of sales:

| Decline or Loss | %Decline or Loss | |

| Property Prices | 2.5 to 5.5 mm | 25% to 55%. |

| Borrower’s Equity | 2 mm | 100% |

| CMBS debt | 500K to 3.5 mm | 6.25% to 43.75% |

If you layer in other factors, for example, if you assume that building’s cash flow decreases by 15% due to higher vacancy or lower rental rates (or the actual rent is lower than the assumed rent in aggressive underwriting), the numbers become worse:

New cashflow is 510 K, which results in new value of 6.375 mm, and new loan of 3.825 mm. With a new buyer paying something between 3.825 mm and 6.375 mm in case of a sale, the range of losses is:

| Decline or Loss | %Decline or Loss | |

| Property Prices | 3.625 to 6.175 mm | 36.25% to 61.75%. |

| Borrower’s Equity | 2mm | 100% |

| CMBS debt | 1.625 to 4.175 mm | 20.31% to 52.19% |

Broad ranges for sure, and you can quibble with the cap rates or LTVs, or the fact that this simple analysis ignores other expenses and complexities, but these are back-of-the-envelope numbers, and give you an idea. For CMBS deals, you also need an estimate on how many loans in a given deal will default. If you assume approximately 40% losses on defaulting loans, then defaults on 20% of loans in the pool will result in 8% losses on CMBS deals, which is somewhere in the middle of the range of losses being predicted by many of the market participants.

Loan extensions can postpone the problem, but not necessarily avoid it, unless the property prices go back to the old levels quickly, which no one expects.

Looking at the example above, one can clearly see the importance and impact of availability of debt. If debt up to 80 LTV were to become available again, that will narrow the ranges above significantly. Clearly, programs like TALF and PPIP that help increase availability of debt are helpful and important. But, they do not solve all problems. They do not help with the decline in value. That pain has to be taken, even though many are trying to ignore it. The current low transaction volume environment reduces confidence in valuations, but eventually volume and clarity on new valuations will both increase. Those who own commercial real estate property with a lot of debt and can not carry it through the downturn will suffer losses they have not recognized yet. But those who have cash and can buy properties at cheap levels in distressed sales will benefit. As always, it will be important to analyze and understand not just the sector, but the individual investments being considered.