What’s Ahead for US Interest Rates?

April 27, 2013

By Malay Bansal

Where are US Treasury yields headed and how fast could they move.

Note: A version of this article was also published on Seeking Alpha.

In early February, the U.S. Treasury made a statement that has not received much attention even though what it implies regarding their thoughts on the future demand for treasury securities (and hence yields) is very interesting. The announcement was mainly about the auction of $72 billion of coupon securities, but it also said that it plans to issue a final rule on floating-rate notes in the coming months, with the first FRN auction expected to occur within the next year. The statement probably did not get a lot of attention because the Treasury has spoken about the idea of floating-rate notes earlier too. However, it had never given a specific time frame in the past. This is significant, not just because it will be first new type of treasury security to be issued since 1997 when the U.S. government introduced TIPS or Treasury inflation-protected securities, but also because what the need for the Treasury to issue these at this time implies about their view on interest rates.

The details on the floating rate notes still need to be worked out. Treasury hasn’t chosen the index to use, and is considering the Treasury 13-week bill auction high rate, Treasury general collateral overnight repurchase agreement rate, etc. All of these will make Treasury’s financing cost variable and expose it to the risk of higher costs in future if the index moves higher.

At a time when yields are low, what is the need to introduce a new security that can result in higher costs as rates increase? The only reason to introduce something that may result in higher cost for debt is the worry that there may not be enough buyers for fixed rate Treasury debt once yields start increasing. With trillion dollar budget deficits and need to refinance maturing debt, if there are not enough buyers, the lower demand will naturally result in yields moving higher quickly.

How much will rates move?

There is almost universal expectation that yields are going higher. Numerous reports and articles over the last few months have mentioned expectations of higher yields and concerns about the risks to investors holding fixed rate debt from various market participants (examples: Barron’s, Bank Of America, PIMCO, Financial Times).

In December 2012, when the 10-year treasury yield was 1.71%, the median forecast from all the 21 primary dealer banks of the treasury market was for the 10-year yield to rise to 2.25% at the end of 2013. In Feb 2013, economist Mark Zandi of the widely used Moodys.com offered “Treasury yields are on track to yield as much as 5% in three years,” (though he caveated his forecast with his assumption of Washington taking the right steps). Bloomberg survey puts the current forecast for 10-year treasury yield to rise from 1.66 at present to 2.25 at end of 2013 and 2.73 at the end of 2014. For 30-year bond yield, the survey predicts yields to rise from the current 2.86 to 3.40 by end of 2013 and 3.82 by end of 2014.

The rationale for rising yields is clear. Easy monetary policies and quantitative easing from central banks around the world are meant to inflate asset prices. How could such large scale of printing money to buy bonds not result in inflation at some point? The economy is slowly improving. And yields are at historical low levels.

The 10-year note yields just 1.66%, 5-year note yields a mere 0.68%. Even the 30-year long bond yields just 2.86%. These puny yields expose bond holders to significant risks if yields rise. For the 10-year note, a 50 basis point increase in yield within the next year will result in price decline of about 4.5%, significantly more than the 2% coupon income. The 5-year note will not do that much better – a 50 bp increase in yield would decrease price by 2.5%, far more than the 0.625% coupon. The 30-year long bond will obviously be hurt the most with its longer duration. A 50 bp rise in yield will result in 9.8% decline in price far outweighing the 3% coupon.

If you expected 10-year yields to increase by 100 bps in next 2 years (forecast mentioned above is a rise from current 1.66 to 2.73 or 106 bps by end of 2014), you would lose about 9% in price and earn 4% in coupon. Would you buy at 1.66 yield or wait for yields to rise to 2.73? To buy the notes now, buyers would want a yield closer to 2.73 now, causing an immediate jump in yield. If you expect yields to rise even more, say 5% after another couple of years, would you even buy at 2.73? As expectations of higher yields take hold, the Treasury will have to immediately pay higher yield reflecting future expectations to entice buyers. This will push yields up quickly towards the expected highs. Given how low yields are, the amount and speed of increase could be significantly higher than in the past. Once yields start increasing, the increase will be further exacerbated by selling from holders of pre-payable mortgage backed securities to hedge their increasing durations (convexity hedging which results from the fact that as yields increase, prepayments on mortgages decrease resulting in higher durations which requires selling of treasuries or swaps to hedge the increase in duration).

Floating rate notes do not have the interest rate risk of fixed rate bonds. So investors are not likely to demand the risk premium that they would need for fixed rate bonds. That is the rationale for the Treasury to issue Floating rate notes.

Are Yields the Easiest Shorting Opportunity of a Lifetime?

Yields are near historical lows and are universally expected to go up. With that, are US yields the easiest shorting opportunity in the market? Not really. As with people sometimes, markets say and do different things and it is important to see what they are doing rather than what they are saying. In this case, if everyone is completely convinced that yields will be higher, why would anyone buy treasuries at these low yields at all? Some of the buying could be attributed to some retail investors not being aware of potential for yields to rise or not being mindful of the risk, or their positions being inconsistent with their beliefs. Some of it could be attributed to flight for safety. However, the fact that yields are near the lows is more an indication of a lack of conviction among larger investors about the rates rising quickly and significantly. The expected inflation over 10 years as implied by yields on 10-year notes and TIPs, at about 2.40, is in the middle of the range of 2.10 to 2.60 for the past year. CPI, at 1.5%, is near the lower end of 1% to 4% range of past three years. Gold prices are lowest they have been in two years. Oil price, at 93, is in the middle of the 85 to 105 range over the last three years. These do not show an obvious immediate concern for inflation. The market is doing something different from what people in it are saying and expecting.

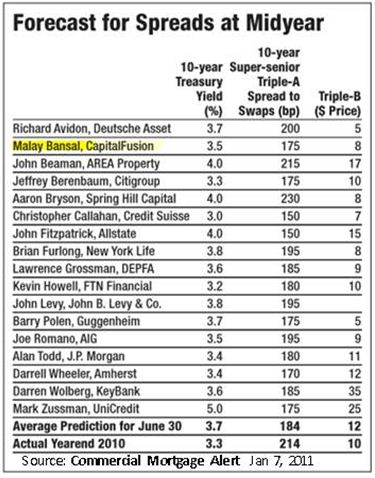

What about the polls predicting higher yields? Interest rates are very hard to predict, even for very smart people. Rates have been low for 5 years now. When they dropped initially, almost no one expected them to stay this low for this long. A look at polls and forecasts from past might also be instructive in that regard. In a poll of Primary Dealers in Jan 2011 the median of forecasts from 17 of 18 primary dealers was for the 10-year note yield to climb from 3.33 percent at that time to 3.50 percent by the end of the second quarter of 2011. The average prediction in a Dec 2011 poll was for 10-year yield to rise from 1.85 at the time to 2.74 by end of 2012 (actual 2012 year-end yield was 1.76).

Even if you do see a bubble in yields ready to pop, getting the timing right can be almost impossible. The lower US yields have persisted for 5 years now even though everyone agrees they should be higher. The Japanese Government Bond market has crushed many investors who tried to short it (the widowmaker trade) and provides an example of the difficulty.

Yields could bounce around in the range they have been in recently (1.60 ish to slightly above 2%) for a far longer time than expected, unless the economy improves quickly or inflation picks up.

What to Look Out for?

The direction of interest rates depends most on the economy and what Fed does with QE program and fed funds rate. One of the most important indicators will be any sign that Fed is beginning to pull back on its $85 billion a month bond purchase program. That will happen before Fed actually starts increasing Fed Funds target rate. Federal Reserve’s decision, in turn, will be based on progress in employment situation, which thus becomes one of the most important indicators.

The Federal Reserve has said that it expects to maintain short-term interest rates near zero, even after it stops buying bonds, for as long as the unemployment rate remains above 6.5 percent, provided that medium-term inflation does not exceed 2.5 percent. A good read on this is an article on PIMCO website which also includes a list of 10 employment related indicators the Fed is watching (Telling Tape Time, Tony Crescenzi, April 2013).

Conclusions

The U.S. is not Japan. Our policy makers have learned from the Japanese experience and have not followed the same path. Also, the economy is showing signs of improvement, though more in some sectors than others. As the economic growth picks up or inflation rises, rates will increase. However, exact timing of that increase is difficult to predict with any type of certainty. Yields could bounce around in the range they have been in recently (1.60 ish to slightly above 2%) for a far longer time than expected, unless the economy improves quickly or inflation picks up. Any strategies or positions taken that depend on rates rising within a certain time frame carry a risk even though the view on the direction may be correct. Even though it is difficult to predict when yields will start increasing, it is easy to see that when yields do start increasing, the increase could be very fast and significant.

Note: The views expressed are solely my own and not of any current or past employers or affiliated organizations.

What’s Ahead for CMBS & Commercial Real Estate in 2013?

January 12, 2013

By Malay Bansal

Why did CMBS perform well in 2012 and what lies ahead.

Note: These views were originally quoted on 19 Dec 2012 in article “Rally Drivers” in Structured Credit Investor. This article was also published on Seeking Alpha.

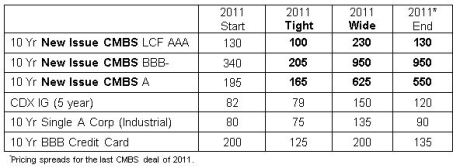

In 2012, the CMBS market had a significant rally as is evident from the table below showing bond spreads over swaps.

|

2011 Year End |

2012 Year End |

|

| GG10 A4 |

270 |

150 |

| CMBS2 Senior AAA (A4) |

120 |

90 |

| CMBS2 Junior AAA |

265 |

140 |

| CMBS2 AA |

400 |

180 |

| CMBS2 BBB- |

700 |

470 |

Not only were the spreads tighter significantly over the year, the performance was better than expectations by almost any measure. Issuance for the year was $48 Bn compared to forecast of $38 Bn. The new issue 10 year AAA spread to swaps ended at 90 compared to forecast of 140, and new issue BBB spreads ended at 410 compared to a forecast of 587 (all forecasts are averages of predictions by market participants as published in Commercial Mortgage Alert). The spread tightening was not limited to new issue either, legacy CMBS prices were up significantly too. Why did CMBS do better than expected, and can this trend of higher issuance and tighter spreads continue?

Why did Spreads Tighten?

There are two widely talked about reasons for spread tightening that generally apply to most of the spread products, and a third one that is specific to and very important for CMBS and commercial real estate.

First driver of spread tightening is the purchase of large amount of mortgage securities by the Federal Reserve under its quantitative easing programs and investors search for yield in this low yield environment.

Second significant factor is that the universe of spread product is shrinking as mortgage payoffs are greater than new issuance. $25-30 Bn of net negative supply per year in CMBS means that the money that was invested in CMBS is returned to investors and needs to be reinvested. More demand than supply leads to higher prices and tighter spreads.

The third factor is a chain reaction that is more interesting and significant. As the above two reasons lead to tighter spreads for new issue CMBS bonds, the borrowing cost for commercial real estate owners decreases. Lower debt service payments from lower rates mean they can get higher loan amounts on their properties. That means a lot of existing loans that were not re-financeable or were border-line and expected to default can now be refinanced and do not need to default. As more loans are expected to payoff and expected defaults decrease, investors expect smaller losses in legacy CMBS deals. That means tranches that were expected to be written off may be money good or have lower losses. So investors are willing to pay more for them, and as people move down the stack to these bonds with improved prospects, the result is tighter spreads for these legacy bonds. Lower financing cost resulting from tighter bond spreads also helps increase liquidity and activity in commercial real estate market as it allows more investors to put money to work at returns that meet their requirements. More activity in the real estate market leads to more confidence among investors and increases real estate values, further reducing expected losses in loans leading to even tighter bond spreads. This chain creates a sort of virtuous circle – the exact opposite of the downward spiral we saw in previous years when the commercial real estate market deteriorated rapidly.

Looking Ahead

As the virtuous cycle mentioned above continues, barring any shocks, spreads can continue tightening and lower financing cost from CMBS means that it can compete more with other sources of financing which means that CMBS volume can keep increasing. Indeed, the forecasts for CMBS issuance for 2013 generally range from $55 Bn to $75 Bn, up from $48 Bn in 2012.

Spreads, however, have less scope for tightening than last year in my view. Looking at historical spreads in a somewhat similar environment (see What’s Ahead for CMBS Spreads? April 4, 2011), CMBS2 AAA spreads could be tighter by 20 bps and BBB- by another 140 bps this year. Generally rising confidence in underlying assets should result in a flatter credit curve, which implies more potential for gains in the middle part of new issue stack. Spreads will move around. Given the unprecedented low yield environment, the search for yield by investors could drive spread slower than expected. At the same time, events in or outside US could cause unexpected widening. The market obviously remains subject to any macro shocks.

One concern cited by many investors is the potential loosening of credit standards by loan originators as competition heats up. That is a valid concern and if industry participants are not careful, history could repeat itself. However, though credit standards are becoming a little looser (LTVs were up to 75 in 2012 from 65-70 in 2011 and Debt Yields were down to 9-9.5% from 11% a year ago), we are nowhere close to where industry was in 2007. Still, investors should watch out for any occurrences of pro-forma underwriting if it starts to re-emerge.

Looking further ahead, maturities will spike up again in 2015-2017, with around US$100bn of 10-year loans coming due. This could cause distress, but hopefully the commercial real estate market will have recovered enough by then to absorb the maturities. Still, it is something that we need to be mindful of for next few years.

For me, one of the most important factors to watch out for is the continued supply of cheap financing for real estate owners. That has been one of the main factors that has brought us to this point from the depths of despair at the bottom and was the basis for programs like TALF & PPIP (see Solving the Bad Asset Pricing Problem) four years ago.

In the current low-growth and low-cap rate environment, investors cannot count on increase in NOI or further decrease in cap rates to drive real estate values significantly higher. That makes availability of cheap financing critical and much more important than historically for achieving their required rates of return to make investments.

Any disruption in availability of cheap financing can quickly reduce the capital flowing to real estate sector and may reverse the positive cycle that is driving spreads tighter and increasing real estate values. Anything that could reduce the availability of financing for commercial real estate owners will be the most important thing I will be looking out for this year other than the obvious factors.

In commercial real estate, hotels and multi-family have improved the most. Hospitality sector, with no long leases, was the first to suffer and among the first to gain as economy started improving. Multifamily sector has done well benefiting from the financing by GSEs. Office and retail sectors have seen increasing activity but face a high unemployment and low-growth environment. If the economy keeps improving at the current slow rate, I think the industrial sector will offer more opportunities and see more activity this year.

Note: The views expressed are solely my own and not of any current or past employers or affiliated organizations.

How Issuers can Increase Investor Interest in CMBS2 Mezz

January 5, 2012

By Malay Bansal

Why New Issue CMBS deals see little interest in Mezz classes and what Issuers can do about it.

A year ago around this time, the mood amongst CMBS market participants was quiet optimistic. Estimates of new issuance for 2011 from market participants generally ranged from $35 Bn to $70 Bn or more, on the way to $100 Bn in a few years. However, over the course of the year, the optimism has faded. New issuance totaled just $30 Bn in 2011, and forecasts are not much higher for 2012.

With more conservative underwriting, higher subordination levels from rating agencies, and wider spreads, new issue CMBS was expected to be attractive to investors. Yet, investors seem to have pulled back, and spreads have widened for both legacy and new issue deals. Macro level issues, especially uncertainty about Europe, are part of the reason. However, CMBS spreads have been far more volatile than other sectors including corporate and other ABS. As the table below shows, even new issue AAA CMBS spreads widened a lot more than other sectors. This spread volatility not only deters investors, but also loan originators from making new loans as they do not have a good hedge to protect them while aggregating loans for securitization. It also requires wider spreads for CMBS loans which makes them less attractive to borrowers.

One of the main reasons CMSB spreads widen quickly is that the sector has far fewer investors than other ABS sectors and corporate bonds. The reason there are fewer investors is that, with fewer loans, CMBS deals are lumpy and investors need the expertise to analyze collateral at the loan level. Not every investor has that expertise. So, they can feel comfortable analyzing RMBS, Credit card, Auto, Equipment, and Student Loan etc deals, but not CMBS. The creation of a super-senior AAA tranche helped bring more investors to AAAs by making the tranche safer needing less analysis. That is part of the reason AAA spreads have tightened.

Spreads for classes below AAA, however, continue to be very wide, as the mezz tranches have even fewer investors. Unfortunately, Insurance companies, which are perhaps the most knowledgeable commercial real estate investors and ones with resources to analyze the CMBS deals at loan level, tend to buy mostly senior tranches. Mezz tranches are left to a very small set of buyers. That means lower liquidity for these tranches, and less certainty about receiving a decent bid if needed. An additional issue is lack of transparency on pricing, as these are small tranches that do not trade frequently and each one is different depending on deal collateral. These factors make these classes even less attractive to buyers.

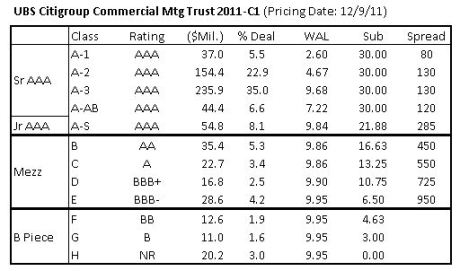

The table below shows the structure of a recently priced CMBS deal. The $674 mm deal has $118 mm of senior AAA, $55 mm of junior AAA, $104 mm of mezz tranches and $44 mm of B-Piece.

What makes Mezz tranches more difficult for investors is that they have lower credit enhancement than AAAs and they are generally very thin tranches representing about 3% to 4% of the deal. In other words, a 3% higher collateral loss could result in 100% loss on the tranche. That means investors require even more conviction and expertise to invest in these classes. The thin tranches are also more susceptible to rating downgrades if any collateral in the deal faces problems. This fear of ratings volatility is another big concern for investors.

One idea, that addresses both the spread volatility and the potential ratings volatility, is to do the opposite of what we did for the AAA – combine all the Mezz tranches into one single class. In this deal, instead of creating classes B, C, D, and E, there could be just one Mezz class. It will be a $104 mm class with average rating of around A-. At a thickness of 15% of the deal, this class will not be at risk of 100% loss if collateral loss increased by mere 3%, and so will be much less susceptible to spread and rating volatility. Also, with just one larger class, there will be more owners of that class and there is likely to be more trading and visibility on spreads, enhancing transparency and liquidity. If the combined Mezz tranche is priced around 640 over swaps or tighter, the issuer will have the same or better economics as with the tranched mezz structure. This will still be a significant pickup in spread for the same rating compared to other sectors and will probably bring in some new investors who were considering CMBS but were hesitant. At about 15%, the Mezz tranche is thicker, but still a small part of the deal. So, even a small number of new investors will make a difference.

And the issuers can try this structure without taking any risk at all. That is possible by using a structural feature that has been used in residential deals (which are also REMICs): Exchangeable Classes. The deal can be setup so that some investors can buy the tranched classes while others buy a single Mezz class. The structure allows owners of one form to exchange for the other form at any point in future using the proportions defined in the documents. This has been used for a long time. I used exchangeable classes extensively in $52 Bn of new CMOs when I was trading and structuring CMOs. Freddie, Fannie, and Ginnie deals regularly have them under the names MACR, RCR, and MX respectively.

There is no single magic bullet, but small changes can sometimes make a big difference. Some, like this one, are easy to try with a little extra work, no downside, and possibility of enlarging the pool of CMBS investors with all the benefits that come from it for investors, issuers, and people employed in the sector.

Note: This article was originally published in Real Estate Finance and Intelligence.

Update 6/15/12: UBS & Barclays introduced an exchangeable class combining part of mezz stack in their $1.2 Bn UBSBB 2012-C2 conduit CMBS deal. The 10 year tranche priced at S+160. The exchangeable class combining AS, B, and C tranches reportedly priced at S+280.

Update 7/9/12: Morgan Stanley & Bank of America introduced a thick tranche combining parts of mezz stack in their $1.35 Bn MSBAM 2012-C5 conduit CMBS deal.

Update 7/30/12: Morgan Stanley used exchangeable classes in $340 mm MSC 2012-STAR CMBS deal.

Update 8/3/12: Deutsche Bank & Cantor Commercial introduced a thick tranche called PEZ combining the AM (junior AAA), B (AA), C (A), and D (BBB+) classes which is exchangeable into individual components in the $1.32 Bn COMM 2012-CCRE2 deal.

Understanding TRX.II

October 5, 2011

By Malay Bansal

Newly launched TRX.II may seem complicated, but is not difficult to understand.

Markit launched TRX.II or TRX 2 indices this week. Details and various documents can be found on their website, but for those not familiar with the working of the index, or if the details on upfront payment and dynamic nature of the index are not clear, this article might help understand the mechanics and the underlying logic.

The Basic Concept

The concept is simple. Going long or buying the TRX.II (or TRX) index is similar to buying a bond. If you buy a bond, you get the coupon. Also, if the spread goes lower or tightens, resulting in lower yield, the bond price increases. Same is true with going long the TRX index. If you go long the index, you get a coupon, and if spread tightens, the value of your position goes up. And just like a cash bond, if spreads widen, the value of the position goes down.

The concept is similar, but there are some differences in implementation as the TRX is a contract (Total Return Swap contract) rather than a physical bond. For one party to go long, there has to be another party to take the short side. All that is needed for a TRX trade are the two parties wanting to take the opposite positions, and neither has to actually own or find the underlying bonds to initiate or close a position. TRX contracts will trade with quarterly expirations with a maximum length of one year. Since the contracts will be standardized, the trade may be initiated with one party taking the other side, and may be closed before expiry, if desired by either party, by doing an opposite trade with a third party. This ability to short easily is what makes it possible for loan originators to hedge their loans being aggregated for securitization.

Once they enter into a contract, at the end of every month, the short party pays the coupon equivalent to the long party. Also, if the spread is tighter at the end of month than at the beginning, then the short side pays the price appreciation calculated based on average duration and spread change to the long side, and vice versa. These payments take place at the end of every month, or till the end of contract. Each month, the spread at the beginning of the month becomes the new starting point for spread change for that month. Also this spread is the coupon that the long party gets for that month. It is paid by the short party and represents the cost of hedging.

Upfront Payment

The main purpose of the upfront payment in TRX is to handle trades initiated in the middle of the month.

For example, if someone goes long on 11th day of month, they should get the coupon only for the remaining 20 days in the month, even though the short will pay full 30 days interest or coupon at the end of the month. So, just like in cash bond, the buyer pays an accrued interest for 10 days to the short. Net result will be the short will pay and the long will get net 20 days of the coupon for that month.

Similarly, upfront payment adjusts for spread movement and traded spread. An example may help. Let’s assume the spread at the beginning of the month was 200, at the time of the trade was 230, and at the end of month was 220. In this case, spread tightened from 230 at the trade date to 220 at the end of month. So, the long party should get payment for the value of 10 basis points tightening at the end of the month. However, the standard payment mechanics will see widening from 200 at the beginning of the month to 220 at the end of the month, and will require the long party to pay the value of 20 bps. The upfront payment provides the adjustment that enables the normal end of month payments to take place in the usual manner. In this case, the upfront payment will be the value of 30 basis points (30 bps widening from 200 at the beginning of the month to 230 trade spread) paid by the short to the long. The net effect will be the long getting the value of 10 bps tightening, as he should.

Revolving Nature of TRX.II

One big difference between TRX and TRX.II is that TRX.II is a dynamic index and has a revolving underlying portfolio whereas the original TRX or TRX.I was a static index. The TRX.II will be rebalanced every quarter to include recent deals meeting the inclusion criteria. The initial TRX.II index has 18 bonds. The index rules specify a maximum of 25 bonds. Once the index reaches 25 bonds, the older bonds will be removed as new bonds are added.

The dynamic nature introduces some complexity, but key points to keep in mind are that all TRX.II trades for a specific maturity are fungible with one another and each payment calculation references spreads and average duration for the same set of index constituents. What that means is that when the index changes, the end of month spread for payment at the end of that month is based on the old index, and the starting index for next month is based on the new version of index with new bonds. To enable this, Markit provides numbers for both the old and new version of the index. Rest of the mechanism stays the same.

Spread Determination

The spreads used for monthly settlements are calculated and provided by Markit based on spreads provided by the ten participating dealers for the underlying cash bonds. The fact that the TRX.II will settle every month to actual cash bond spreads means that it will be expected not to stray too far from cash bond spreads. The resulting high correlation with spreads on recently issued cash bonds makes the TRX.II a good hedge for loan originators.

The dealers provide spreads on the individual constituent bonds, not the spread for overall indices, which are computed by Markit. This ensures consistency between spreads for the old and new versions of the index, when the index is adjusted to include new deals.

For the more technically oriented, Markit’s calculation methodology involves using individual bond cashflows to calculate prices from the average bond spreads for each bond and then using aggregated index cashflows and average price to generate index spread, weighted average life, and duration. The end of month calculation of price change from spread change uses the averages of beginning and ending durations and index prices, which captures the majority of the convexity effect.

Outlook for TRX.II

I have asked for creation of a new TRX index for a long time (Restarting CMBS Lending, Feb 9, 2010). So I am happy to see it getting launched. I also like that Markit created a dynamic index which will always reflect spreads on new issue bonds, though that makes it more attractive to hedgers than to investors who may prefer to go long a known set of bonds.

TRX.II is a much better hedge than CMBX as it settles every month based on cash spreads and so is correlated with cash bond spreads, unlike CMBX which pays only when there are actual defaults (far into the future) and can trade purely based on technical factors with no correlation to new issue cash bond spreads. TRX.II is also a better hedge than TRX.I which references the old legacy CMBS deals and does not correlate well with new issue CMBS spreads.

One question on the minds of many people is if the index will gain traction. The general view is that the demand from originators will be there to short to hedge loans being aggregated for sale via securitization, but there may not be enough demand from the long side. It may turn out to be the other way. With spreads wide at present and few deals in the pipeline, the index may see more demand from long side than short side. Hedging of loans for spread movement today is not an almost mechanical process it used to be (CMBS Hedging Requires a New approach, July 5, 2011) and different originators favor different strategies. However, no matter what method is used, hedging has a cost. When spreads are wide and expected to tighten, many originators prefer to hedge just the interest rates and not the loan spreads. Barclays created a CMBS 2.0 index earlier in the year, but it has not been used much, partly for that reason. The TRX.II may benefit from the fact that some originators are now being pushed by their risk management groups to be fully hedged, and TRX.II will have higher correlation with actual cash bond spreads than any alternative. Also, TRX.II has ten licensed dealers. So, there may be more liquidity and more openness by their internal origination groups to use it for their hedging.

How to Finance Infrastructure and Clean Energy Investments

September 2, 2011

By Malay Bansal

Investments in clean energy and infrastructure projects can help address the unemployment problem and make American business more competitive. The challenge is financing these investments in the current environment. There is a creative solution available that does not require new taxes, printing more money, or increasing the deficit.

The President is set to propose investments in infrastructure and clean energy in his jobs speech next week. There are several reasons that make spending on infrastructure and clean energy a good idea at this time: the jobs created are local and cannot be exported, the jobs created are in sectors like construction that are facing higher unemployment, it generates demand for products and services from a variety of industries creating more jobs, deteriorating US infrastructure is sorely in need of maintenance, and now is a good time to make these investments as raw materials and labor are cheap (maintenance is necessary and overdue – not doing it now just means that it will have to be done at a later time when it will likely cost more).

Even though infrastructure investment is a good idea, it faces two big problems.

First is the need to finance these investments. With the focus on reducing deficit, it will be difficult to get everyone to agree on spending money on these projects. The President has made similar proposals in the past. Republicans are almost certain to oppose more spending and any taxes to pay for it this time too. The bankruptcy filing this week by the solar power panel maker Solyndra, which had $527 million in loans from Federal government, and had been praised by the President, will be held up as an example by many of a poor government investment that put public money at risk, and a reason why government should not get involved.

The second problem is picking projects that are productive and not just a waste of money. Government may not be the best judge for picking the best projects.

The solution to both problems is increased involvement of private sector.

However, to get the private sector to invest in infrastructure projects, the government has to provide incentives, but in a way that does not increase deficit or taxes. One creative possibility for doing this may be by using the estimated $1 trillion of unrepatriated profits US companies hold in foreign subsidiaries.

American companies can generally defer paying taxes on foreign profits as long as they keep the money outside US. When they bring the money back to US, they have to pay the top corporate tax rate of 35%. To defer taxes, US companies generally have left large sums of profits in their foreign subsidiaries. These untaxed profits are part of the reason large multinationals have lower overall tax rates for which they have been criticized at times.

The administration has proposed taxing worldwide income of US companies, but faced strong opposition since that would put the US companies at a competitive disadvantage.

On the other end, US companies are arguing that they could bring back the earnings in their foreign operations if the US government offered a tax amnesty and permitted them to repatriate foreign earnings at a low rate of around 5% instead of the 35% federal tax they face at present. They argue that 5% tax could bring $1 trillion back to US for increased economic activity and could generate additional $50 billion in federal tax revenue.

The tax amnesty will not result in an increase in deficit or taxes, as government is giving up what it is not getting anyway – without it, these funds will not come back into the US economy, and the Treasury will not get the additional tax revenue.

However, the tax holiday idea has been opposed by many as the funds brought back will not necessarily be used to generate jobs. The companies could use the money for M&A activity, stock buybacks, and paying out dividends. A similar tax-amnesty program was implemented in 2004. However, of the $362 billion that was repatriated, very little was used for actual investments to create jobs.

A better idea, one that addresses this concern, will be to offer the tax amnesty only to the funds brought back that are actually invested in infrastructure and clean energy projects in the US. However, money is fungible, and it can be easily moved from one bucket to another. To ensure that the tax break really results in investments that create jobs, the repatriated money has to be separated from the other funds of the repatriating company. Hence, for this idea to be effective, the funds brought back must be invested with third-party private fund managers for a minimum number of years to qualify for the tax break.

A limited time tax amnesty will encourage US companies to repatriate earnings back to US quickly. A requirement to invest in infrastructure projects for a minimum fixed number of years (say something between 3 to 5 years) will ensure that the funds brought back create jobs. Companies will be allowed to invest in either debt or equity depending on their risk-reward preferences. Government will not be involved in making investment decisions. All investments will be chosen and managed by private fund managers, who will pick projects and investments based on sound economic calculations of cost-benefit and expected returns. The companies will be free to pick any fund manager based on their judgment of manager’s capabilities and investment strategy.

This basic framework could be enhanced in several ways. Companies could be encouraged to invest for a longer period by offering to reduce any taxes on the earnings from the infrastructure investments, if the investments are held for say 7 to 10 years or more. Also, companies could be allowed to use part of funds brought back to build new plants for their own use, or setup funds that finance purchases of company’s products.

This proposal is a middle of the road approach which addresses the problems the US economy is facing in a productive way and should be acceptable to both sides. Even if there are plans to change rules to tax worldwide earnings of US companies in future, it still makes sense to address the past earnings that are held outside US.

Longer term, the US needs to develop regulations that clarify and encourage private sector investment and involvement in the clean-energy and infrastructure sectors, both of which are essential for the growth and competitiveness of the US economy in the longer term. The areas that need attention from lawmakers and regulators include Public-Private Partnerships, securitization of infrastructure financing, and eligibility rules for MLPs and REITs.

Note: I originally wrote about this idea in November 2010 and shared it with several policy-makers, elected officials, industry chieftains, think-tanks, and members of the media. Given the state of the economy, the idea is more timely and urgent now. The original, more detailed, article is at https://marketsandeconomy.wordpress.com/2010/11/23/tackling-the-us-unemployment-problem/.

Strategy for Tablets – What would Steve Jobs do at Microsoft?

August 27, 2011

By Malay Bansal

Decision by Steve Jobs to step down has inspired tributes to him and speculations about the future of Apple without the iconic visionary at the helm. This article explores a different question.

In the last ten years, Apple stock has gone from $7.75 to $383.50. Microsoft, on the other hand, is now at $25 and change, the same level at which it was ten years ago. Apple’s success, for sure, is not the result of just Steve’s effort, but he was the one who picked key players and built the team. So, it may be a fair and interesting question to ask what would Jobs do if he were running Microsoft.

The iPad tablet has been a big success for Apple. Popularity of Tablets is seen as partly reducing the demand for Windows laptops. As more and more people use non-Windows tablets, and tablets become more powerful, they could in fact become a threat to the dominance of Windows and Office suite. Each one generates about 40% of Microsoft’s operating income, and it is important for Microsoft to defend these extremely profitable and currently dominant core businesses from the shift in user preference towards tablets. Since Jobs really created the space, how would he compete if he were at Microsoft? It is an easy conclusion that he would create a new Windows based tablet that would become a must have for everyone, but what would that tablet look like?

iPads and similar tablets are great – for reading and browsing the web etc. What could be the next step up from there? Imagine if you could also write on the tablet screen with a stylus? That would be a true advance – a game changer. If you are an executive, you could not only read business documents, but also take notes in meetings just by writing on the screen. Or, if you are a student, you could not only read your text books, but also take notes in the class on the tablet – no need to carry heavy text books and paper notebooks. If you wanted to use a program like Word or Excel or a database, you could just run it. Wouldn’t that be a great device to have? You wouldn’t need to carry a separate laptop anymore! One device will do the work of both.

The good news is that such a device exists and is available for purchase today. It is called Windows Tablet, has been available for a long time, and works very well. I say that from personal experience – I bought my first tablet eight years ago – seven years before iPads came on the scene – and my current one, a Lenovo ThinkPad tablet, almost four years ago. It’s a laptop with full keyboard, but I can flip the screen over the keyboard and it becomes a tablet. Though it is bigger than iPad and Android tablets, it provides a bigger screen, a much bigger hard drive, a full keyboard and lets me run all Windows applications including Excel, Word, and Powerpoint. I can use a stylus to write or draw on the screen just as I would on a piece of paper – something that one cannot do in iPad and other tablets. It even has handwriting recognition built in that can convert handwriting to text. I can read documents just as I would a paper document – can highlight or underline words or sentences, make notes in my handwriting on the side, etc. – and then save it for referring to it again in future. No longer do I need to print or save paper copies of all the market research and documents I read. When I review deal documents, instead of printing those thick documents, marking comments, and faxing it back to lawyers, I am able to simply write on the screen, save the pdf file, and email it back, saving a lot of time and trees. In meetings, I take handwritten notes on the tablet with a pen-like stylus with the screen lying flat on the table and not blocking the view or acting like a barrier.

Apple’s iPad was a huge success as soon as it came out. Yet, Windows tablets are great and have been available for some time, but have never caught on. There are two reasons for that. First, very few people seem to know about them, as they have never been advertised or promoted seriously. Second, they were priced too high. Expectation was that the cost will come down as sales volume increased. But high price has also been a deterrent to higher sales.

Windows tablets are not the only unpromoted product from Microsoft. It has another product that I think is easily one of the best software products ever created by the company – the Microsoft OneNote. It is part of the Office suite, yet very few people know about it. OneNote is like having a bunch of virtual spiral paper notebooks that allow you to organize and collect all kinds of information on your computer. Each notebook has tabbed sections which contain pages. You can put almost any kind of data – hand-written notes, typed text, tables, pictures, audio, video, screen clippings, other files – on the pages. The user interface is simple and elegant and the program takes very little memory to run. You can search even in hand-written notes and text in pictures and screen clippings. From some of the posts on the web, I suspect it might have been an almost accidental product developed by a very small group of people rather than something that was planned.

Combination of OneNote and tablet is the killer application for Windows platform that can be a game changer if it is priced and marketed appropriately. I have seen no serious attempts to promote it from Microsoft, but in the hands of someone like Jobs, the combination would be golden.

Low prices for iPads and Andriod tablets have resulted in huge sales numbers. That has led PC manufacturers to try to compete by creating lower-priced smaller screen windows tablets. However, windows systems need more memory, bigger hard-drive, more powerful processors, and bigger screens. That makes them more expensive. Ability to write on screen also adds to the cost. So, Windows tablets can’t really compete on price. Luckily, for Microsoft, they do not have to. What it needs for its core businesses of Windows and Office suite, which generate about 80% of its operating income, is that people who use Windows today do not move to other platforms running on tablets, as tablets become more powerful. This goal can be achieved by focusing on the segment that needs or wants both a laptop and a tablet, like business professionals and students. This can be done by taking steps to promote availability of a Windows device that provides functionality of both in one device. The price for this device does not need to be as low as iPad – it just has to be same or lower than the total price for the two devices purchased separately – to have a huge demand from people who will be looking to upgrade their old PCs and laptops. Clearly, that should be achievable. Intel has a lot to gain from this too and could be a partner in this effort.

Better design and marketing of existing products would be one focus for Jobs. Pricing would be another one. Apple had the guts to design a product and negotiate contracts for large scale production without knowing how much demand there would be. From some of the reports, Apple had bought a lot of flash memory (some were worried about enough supplies for others) for iPods, even before the product was announced and there was no way to predict demand for that new product. He created products that no one asked for, but marketed brilliantly, and sold products at prices where there was likely to be significant demand.

Steve Jobs genius would be to realize the potential, design and negotiate aggressively with suppliers to reduce costs, and promote it like a new game changing technology that everyone needs to have, the way he did it at Apple, and sell it at a price that would attract lots of buyers.

However, at Apple, he did have an advantage over Microsoft since Apple controls both hardware and software in its products. In the Windows world, the software comes from Microsoft, processors from Intel, and the computers from a bunch of different manufacturers. That leaves the Windows tablet without a clear champion. It is not a big revenue generator for any of the parties involved. So it does not get focus, and there is no one with enough volume to drive prices lower.

To compensate for lack of control over hardware, Microsoft can create reference design specs to guide PC makers, in the same way as Intel does when it releases entire designs for motherboards that are based on its microprocessors, which are used by PC manufacturers to build computers (that is why motherboards from different manufacturers look very similar). Microsoft does not have to go as far as to create designs – it could just create design specs. It could also negotiate volume discounts for some parts for manufacturers who choose to build computers meeting those specs.

Jobs would go further – for example, working with textbook publishers to make books available on the tablets, creating programs making it easier for professors to distribute class handouts and collect papers to grade, etc – and almost make it necessary and fashionable for every student and every executive to have one.

What will a game changer Windows Tablet look like? One with the following specifications is doable with current technology at a reasonable price:

- Has two screens. Screens are 12.1” in size allowing better fit for the common Letter size page.

- One screen is meant for reading and has touch screen ability like iPads.

- The second screen also allows you to write or draw directly on the screen with the included pen stylus.

- Can be opened like a book or executive folder with screens in portrait mode and both lying flat on the table. Left screen for reading & right for writing. Or could form a single display for large spreadsheets.

- Can also be opened like a regular PC with screens in landscape mode – one screen lying flat on the table and the other standing vertical. Users can bring up a virtual keyboard on the lower screen.

- Separate blue-tooth keyboard of same size as the tablet to allow easier storage and carrying.

- Boots and wakes up from sleep quickly from a small SSD built into the motherboard, but also includes a larger capacity hard-drive instead of just a 16 or 32 GB drive that most tablets have.

- Long battery-life. Optional thin sheet-batteries that can be attached or stacked at the bottom.

New ideas and better marketing can only help a stock, which despite all the potential, a healthy 2.5% yield, tons of cash, and a stellar balance sheet, trades at close to its lowest historical multiple at a PE of 9.6.

In the end, only Steve Jobs knows what he would do if he were running Microsoft. The above is just my view, and the tablet described is the one I want to buy. But, Ballmer and team can only benefit by asking themselves the question – what would Steve Jobs do if he were running Microsoft?

Since none of Steve Ballmer, Tim Cook, Larry Page, or Paul Otellini is likely to be reading this article for advice on business and product strategy, what is my point for everyone else? It is simply that it is possible for Microsoft to make significant gains in its stock price by using the assets it already has by thinking more like Steve Jobs, but if Apple, Google or someone else comes up with a non-Windows device that is able to replace both a laptop and a tablet, that may be the start of the end of Windows dominance. People could move to an Apple OS and still have Office applications, but over time a move away from Windows could also lead to move away from Office applications. Watch out for MSFT stock in that scenario. Also, check out Windows tablets and OneNote – if you work with information, you might be able to get immediate dividends in form of saved time and increased productivity.

Note: A version of this article was published on Seeking Alpha: How Microsoft Can Win The Tablets War

Disclosure: I have small positions in MSFT and INTC options, but I am not affiliated in any way with any of the companies mentioned.

UPDATES:

- Microsoft announced Windows based Surface Tablets with keyboards in June 2012.

- In 2014, Microsoft made OneNote available for free but with restricted functionality.

- In 2015, Microsoft made the full version of OneNote available for free to everyone.

Historical factors sometimes result in favoring Oil & Gas over the newer renewable energy technologies. Eligibility for MLPs is one such area that can be easily fixed.

Note: This summary presents the key points of the article The Case For Master Limited Partnerships (John Joshi & Malay Bansal, July 20, 2011) published on AOL Energy.

The need for additional capital to flow into renewable energy is clear. The sector has a strong dependence on government incentives while it develops towards price parity with conventional energy sources. Recently, Section 1603 Cash Grant program and the section 1703 and 1705 loan guarantee programs have provided some support. However, many of these programs are scheduled to expire in near future. In the past, the sector depended on tax-equity market for financing of projects. But, with lower profits especially at commercial banks which were active in the tax-equity markets, that market will not be able to play the same role as in the past. The clean energy sector needs more help.

The traditional energy sector has available to it a source of capital in form of MLPs (Master Limited Partnerships) that can invest in Oil and Gas. The MLP structure was created by Congress following the energy crisis of the 1970’s to spur investment in the energy sector for oil and gas exploration, storage, refining, and transportation by providing specific tax advantages to investors. The MLP structure provides the tax benefit of a limited partnership and at the same time provides liquidity of common stock since the PTP (Publicly Traded Partnership) units trade on exchanges just like common stock. Since the MLPs generally hold income producing assets, the resulting high dividend attracts a lot of investors, providing capital to the sector.

Income earned from renewable energy projects, however, is not considered eligible for MLPs. This is because of historical reasons more than anything. When this law was passed in 80s, renewable energy sources were not in the same state as today. This historical factor results in favoring the old energy over the newer renewable sources. Political factors aside, a simple legislation by Congress can correct this to level the playing field. Infrastructure is another sector that is in need of capital, and could also be included.

This, by itself, will not be sufficient, but will be a logical and helpful step in the right direction.

Update 6/8/12: Sens. Chris Coons (D.-Del.) and Jerry Moran (R-Kan.) introduced the Master Limited Partnerships Parity Act (no bill number yet), which would amend the federal tax code to allow investors in renewable energy & bio-fuels projects to form master limited partnerships.

CMBS Hedging Requires a New Approach

July 5, 2011

By Malay Bansal

CMBS loan hedging issues have often tripped even smart real-estate lenders. The current environment requires a careful and different approach than in the past.

Recent spread widening and volatility in CMBS market have drawn attention to hedging issues for loan originators in securitization shops.

An article in this week’s Commercial Mortgage Alert (New Markit Index May Solve Hedging Woes) reported comments from market participants that the recent spread widening, which was equivalent to about 3% decline in value of loans held, hit all lenders, though to different extent depending on their hedging approach. In an increasingly competitive market with declining profit margins in loans, a 3% hit is clearly very significant for any origination business.

Last week, a Bloomberg news story reported that spread volatility was as an important factor in Starwood Property Trust’s decision to back away from originating debt that would be sold entirely into securitizations.

Hedging issues, even when people believed they were hedged, have tripped many very smart real estate lenders in the past. During the previous crisis, after the Russian debt problems in late 90s, the hedges made a huge difference. At the time, many CMBS lenders hedged using only treasuries. Only some used swaps. Those who used only treasuries were hurt doubly as treasury yields declined increasing the prices of treasury hedges they were short, while swap spreads jumped higher decreasing the value of their assets which were valued at a spread over swaps. Those who had hedged using swaps did not suffer that much. Those who did not use swaps had devastating losses. After that painful experience, everyone in the market moved to hedging with swaps.

Hedging with swaps still left the risk of adverse movements in CMBS bond spreads, a smaller risk most of the time. Few years later, as competition increased and profit margins declined, some started using total return swaps on the Lehman CMBS indices (now Barclays Indices) to hedge that risk too. Those legacy indices are not useful now as they contain old deals. Some people have turned to CMBX1 for hedging, as it is closest to the new issue bonds amongst the five CMBX indices. CDS on IG Corp indices have been used at times by some, and I have heard people exploring use of other tools like equity indices. However, all of these approaches need to keep in mind that any hedge used needs to have a very good short-term correlation with new-issue CMBS bond spreads – longer-term relationships do not mean anything. If the hedge can move in the opposite direction of the asset in the short-term, it’s not really a hedge.

Lack of a good hedge was one of the reasons that delayed restarting of CMBS lending. Last year, I suggested to Markit to create a new TRX 2 index based on the few new deals that had been done so far (Restarting CMBS Lending, Feb 9, 2010). The idea did not get much traction then. Julia Tcherkassova, who heads CMBS research at Barclays, articulated the need for a CMBS loan hedging mechanism internally, resulting in Barclays creating a US CMBS 2.0 Index earlier this year. That index provided a mechanism to hedge loans but it was not used much.

An instrument existed to allow hedging of loans but no significant attempt was made to use or develop liquidity in it by the industry. The reason is probably as simple as the fact that new issue spreads were generally in a continuous tightening mode till the recent sudden widening episode, and that made spread hedging seem not that important. Another factor is that the hedging is expensive. In the past, the cost of hedging with Lehman index was around 30 bps (on an annualized basis). With CMBS2 indices, that cost would have been about 110 bps. Given that the loan volumes are lower, giving up profitability becomes tougher. So the new Barclays index came, but was not met with a strong demand and remained unused. The wider bid-ask spreads also make hedging expensive.

Commercial Mortgage Alert reported that Markit is close to rolling out a new TRX index, dubbed TRX.2. Since it is coming out after a widening that was painful for many, it might attract more attention. Hopefully, it will provide a liquid instrument that can be used effectively for hedging loans being aggregated for securitization.

However, another point to think about is that the new TRX index will likely come with or be followed by new CMBX indices. It remains to be seen if the new synthetic CMBX indices will introduce more volatility in cash markets as did the legacy CMBX indices. One thing is sure though – hedging is as important as anything else for loan originators and needs to be given proper attention. All the careful real estate analysis while making loans can come to nothing if sufficient attention is not paid to hedging while loans are being aggregated for securitization. Mechanically following the past methodologies will not be the best approach. The current environment calls for adjustments and creative ideas for hedging to be effective and less costly.

What’s Ahead for CMBS Spreads?

April 4, 2011

By Malay Bansal

A revived CMBS market, with new deals getting done, is helpful to REITs and other commercial real estate owners as it has started making financing available again. Spreads had generally been narrowing which helped loan originators by reducing the hedging cost and has been good for owners of CMBS bonds. However, recent spread volatility has left some people concerned, and wondering about the future direction of spreads and how to look at spreads on the new CMBS 2.0 deals in the context of 2006-7 legacy deals.

I always find it useful to start with views of market participants, and historical data for some perspective. Also, for legacy deals, estimates of losses are an important element. Below are forecasts for spreads for 2007 vintage CMBS for June 2011 published by industry’s weekly newsletter, Commercial Mortgage Alert at the beginning of the year, along with some other data. Comments and thoughts follow.

| Loss Estimates (%) by Market Participants | |||||

|

S e t |

CMBX1 (2005) | CMBX2 (2006) | CMBX3 (Early 2007) | CMBX4 (Late 2007) | CMBX5 (Late 2007/ 2008) |

| 1 |

6.7 |

7.2 | 10.3 | 12.0 | 9.9 |

| 2 | 6.6 | 8.3 | 10.9 | 13.9 | 12.3 |

| 3 | 4.2 | 6.2 | 6.9 | 8.8 | 7.5 |

| 4 | 6.8 | 8.4 | 11.8 | 15.6 | 13.3 |

| 5 | 7.0 | 10.1 | 12.7 | 14.0 | 13.9 |

| Note: Loss estimates from market participants including sell-side research group, rating agencies, and advisory services. Periods for each CMBX series are approximate. | |||||

|

Recent Spread History |

||||

| Spread Over Swaps |

Dec 2010 |

11 Feb 2011 |

18 Mar 2011 |

1 Apr 2011 |

| Generic 2007 A4 |

215 |

150 |

195 |

165 |

| GG10 A4 |

245 |

190 |

240 |

190 |

| CMBS 2.0 AAA |

130 |

110 |

120 |

110 |

| Historical Spreads | |||

| Average Spread Over Treasury | 2003 | 2004 | 2005 |

| CMBS AAA | 78 | 72 | 74 |

| CMBS AA | 87 | 79 | 85 |

| CMBS A | 97 | 88 | 95 |

| CMBS BBB | 150 | 125 | 147 |

| CMBS BBB- | 200 | 164 | 196 |

| Corp – Generic A Rated Industrial | 88 | 69 | 74 |

Recent Spread Widening

To focus first on what had people worried most recently – widening of GG10 A4 bonds by 50 basis points from mid Feb to mid March, it is important to step back and look at the bigger picture. GG10 spreads are more visible because it is a benchmark deal and trades more frequently. As the table “Recent Spread History” shows, (i) spreads did widen out, but are generally back to where they were before widening, and (ii) even when they widened out, they were inside where they were at the beginning of the year.

Another factor to look at is where spreads are compared to market’s expectations. The table above shows average prediction for 2007 vintage A4 bonds to be 184 over swaps. Mid March wide was swaps + 190 and the current spreads are swaps plus 165. Again, not as alarming when looked at in that context.

CMBS 2.0 Spreads

Spreads for new CMBS 2.0 deals widened out too, but not by as much. They went from 110 over swaps at the tight to 120 and are back to 110, compared to swaps plus 130 at the beginning of the year. Spreads did not widen much, but where could they go now? One perspective is looking at the history. The underwriting, leverage, and subordination in the new deals are comparable to what they generally used to be 2003 to 2005. However, looking at spreads over swaps at that time will not be as helpful because of the impact of recent events in swap markets. A better approach will be to look at spreads over the risk-free rate, or the spread over treasury notes. In the 2003 to 2005 period, CMBS AAA bonds averaged around T+75, whereas generic single-A industrial corporates averaged T+77. Currently, new CMBS spreads are swap plus 110 or T+117 and single-A industrials are T+97. This back of the envelope analysis would suggest that new CMBS AAA spreads could tighten by 20 basis points from the current levels. The demand for bonds is there and there is not a big supply in the pipeline. So the technicals favor continued tightening.

CMBS 2.0 Vs Legacy CMBS

Legacy CMBS deals are a bit more complicated given the losses expected by market participants (see table above). In general, expectations of losses seem to average around 11.5% for 2006-8 deals. One simple way of looking at the deals would be to assume subordination remaining after expected losses. On that basis adjusted subordination for legacy A4 bonds goes from 30 to 18.5, which is similar to the subordination for AAA bonds in new deals. Subordination for legacy AM bonds with loss taken out goes from 20 to 9.5. That is roughly between single-A and BBB bonds in new deals.

This simplistic approach ignores several other factors that also come into play, but does the market see these as comparable? Market spreads for legacy AM bonds, at swap plus 280 seem wider than 190 and 270 for new deal single-A and BBB bonds. Similarly, legacy A4 spreads at S+170 are much wider than S+105 for new issue AAA bonds. However, if you look at yields, legacy A4 is around 4.65, close to the 4.60 on new issue AAA. Similarly 5.80 yield on legacy AM bonds is between 5.42 and 6.22 on new issue single-A and BBB bonds.

Logical inference from above is that, in this yield-hungry world, the legacy bonds are generally in line with the new issue bonds in terms of yield, and legacy bonds should tighten along with new issue. The choice between them comes down to investors preference for stability, hedging, leverage, duration, etc.

The above would suggest that a general widening in legacy but not in new issue bond spreads, unaccompanied by any deal specific news, as happened recently, may be an opportunity to pick up some cheap bonds if you can do detailed deal analysis and are confident in ability to pick better deals.